Investing in off-plan properties has become a popular strategy in Qatar’s real estate market, offering potential buyers the opportunity to secure property at a lower price before it’s fully constructed. With Qatar’s booming economy and continuous development projects, the allure of off-plan investments is growing. However, like any investment, it comes with its own set of risks and rewards. This blog will explore the pros and cons of investing in off-plan properties for sale in Qatar, addressing common questions and providing insights to help you make an informed decision.

What Are Off-Plan Properties?

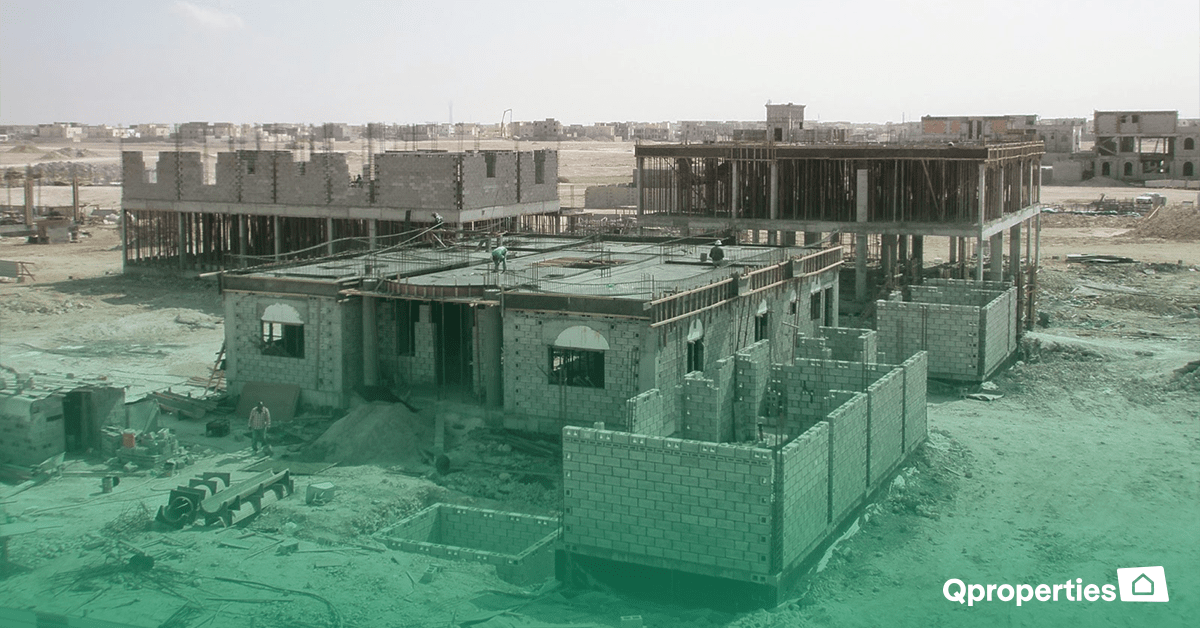

Off-plan properties refer to real estate that is sold before construction is completed, often based on architectural plans and developer promises. Buyers typically pay a lower price compared to completed properties, with the expectation that the value will increase by the time the property is ready for occupancy. This type of investment is common in rapidly developing regions like Qatar, where new projects are constantly being launched.

The Pros of Investing in Off-Plan Properties in Qatar

1. Lower Purchase Price

One of the most significant advantages of investing in off-plan properties is the potential to buy at a lower price. Developers often offer attractive pricing during the pre-construction phase to incentivize early buyers. This lower entry price can result in substantial capital appreciation by the time the property is completed, providing investors with an opportunity to maximize returns.

2. Potential for High Returns

In a growing market like Qatar’s, where demand for high-quality residential and commercial spaces is strong, off-plan properties can yield high returns. As the project nears completion, property values typically rise, allowing investors to sell at a profit or enjoy increased rental income.

3. Payment Flexibility

Developers often provide flexible payment plans for off-plan properties, allowing buyers to spread payments over the construction period. This flexibility can make it easier for investors to manage their finances and invest in multiple properties simultaneously.

4. Customization Options

Investing in an off-plan property gives buyers the chance to customize the property to their preferences. From choosing finishes to altering layouts, early buyers often have more input in the final design, which can add value and personal satisfaction to the investment.

5. Modern Amenities and Designs

New developments in Qatar are often equipped with the latest amenities and designed with modern lifestyles in mind. Investing in an off-plan property means securing a home or commercial space that meets contemporary standards, often with energy-efficient features and smart home technologies.

The Cons of Investing in Off-Plan Properties in Qatar

1. Construction Delays

One of the primary risks associated with off-plan properties is the potential for construction delays. While developers aim to meet deadlines, unforeseen circumstances like regulatory changes, financial issues, or logistical challenges can push back completion dates. These delays can impact your investment timeline and rental income expectations.

2. Market Volatility

Real estate markets can be unpredictable, and an economic downturn or oversupply of properties could reduce the value of your investment. In such scenarios, the anticipated capital appreciation may not materialize, or the property may take longer to sell or lease.

3. Developer Risk

The success of an off-plan investment is closely tied to the developer’s reputation and financial stability. If a developer encounters financial difficulties or fails to deliver on their promises, investors may face incomplete projects or subpar construction quality. It’s crucial to thoroughly research the developer’s track record before committing to an off-plan purchase.

4. Limited Immediate Returns

Unlike completed properties, off-plan investments do not provide immediate rental income. Investors must wait until the project is finished before generating revenue, which can be a drawback for those seeking short-term returns.

5. Changes in Market Conditions

While investing in off-plan properties offers the potential for high returns, it also exposes investors to changes in market conditions. Factors such as fluctuating interest rates, changes in real estate laws, or shifts in buyer demand can affect the value of your investment.

Frequently Asked Questions About Off-Plan Investments in Qatar

1. What should I consider when choosing an off-plan property in Qatar?

When choosing an off-plan property in Qatar, consider the location, developer reputation, and market trends. Prime locations like West Bay, Lusail City, and The Pearl offer higher potential for capital appreciation. Additionally, working with a reputable developer with a proven track record can minimize risks. Lastly, stay informed about market trends and future infrastructure developments that could impact property values.

2. How can I protect my investment in an off-plan property?

To protect your investment, ensure that the developer is financially stable and has a good reputation. Review the terms of the contract carefully, including the construction timeline, payment schedule, and any clauses related to delays or changes in the project. It’s also advisable to seek legal counsel to understand your rights and obligations fully.

3. What are the payment options for off-plan properties in Qatar?

Most developers offer flexible payment plans for off-plan properties, allowing buyers to make payments in installments throughout the construction period. Common payment structures include an initial deposit followed by regular payments aligned with construction milestones. Some developers may also offer post-handover payment plans, allowing you to pay a portion of the property price after completion.

4. Are off-plan properties a good option for first-time investors?

Off-plan properties can be a good option for first-time investors if they are willing to accept the associated risks. The lower entry price and potential for high returns make it an attractive investment. However, first-time investors should conduct thorough research, seek advice from real estate professionals, and ensure they have a clear understanding of the market dynamics before proceeding.

5. How does the legal process work for off-plan property purchases in Qatar?

The legal process for purchasing off-plan properties in Qatar involves signing a Sales and Purchase Agreement (SPA) with the developer. This agreement outlines the terms of the sale, including payment schedules, construction timelines, and penalties for delays. Buyers should ensure that the SPA is registered with Qatar’s Real Estate Registration and Authentication Department to protect their rights.

Conclusion

Investing in off-plan properties in Qatar offers a unique opportunity to enter the real estate market at a lower cost and potentially reap significant rewards. However, it’s essential to weigh the pros and cons carefully and make informed decisions. By considering factors such as developer reputation, market conditions, and legal protections, you can mitigate risks and maximize the benefits of your investment.